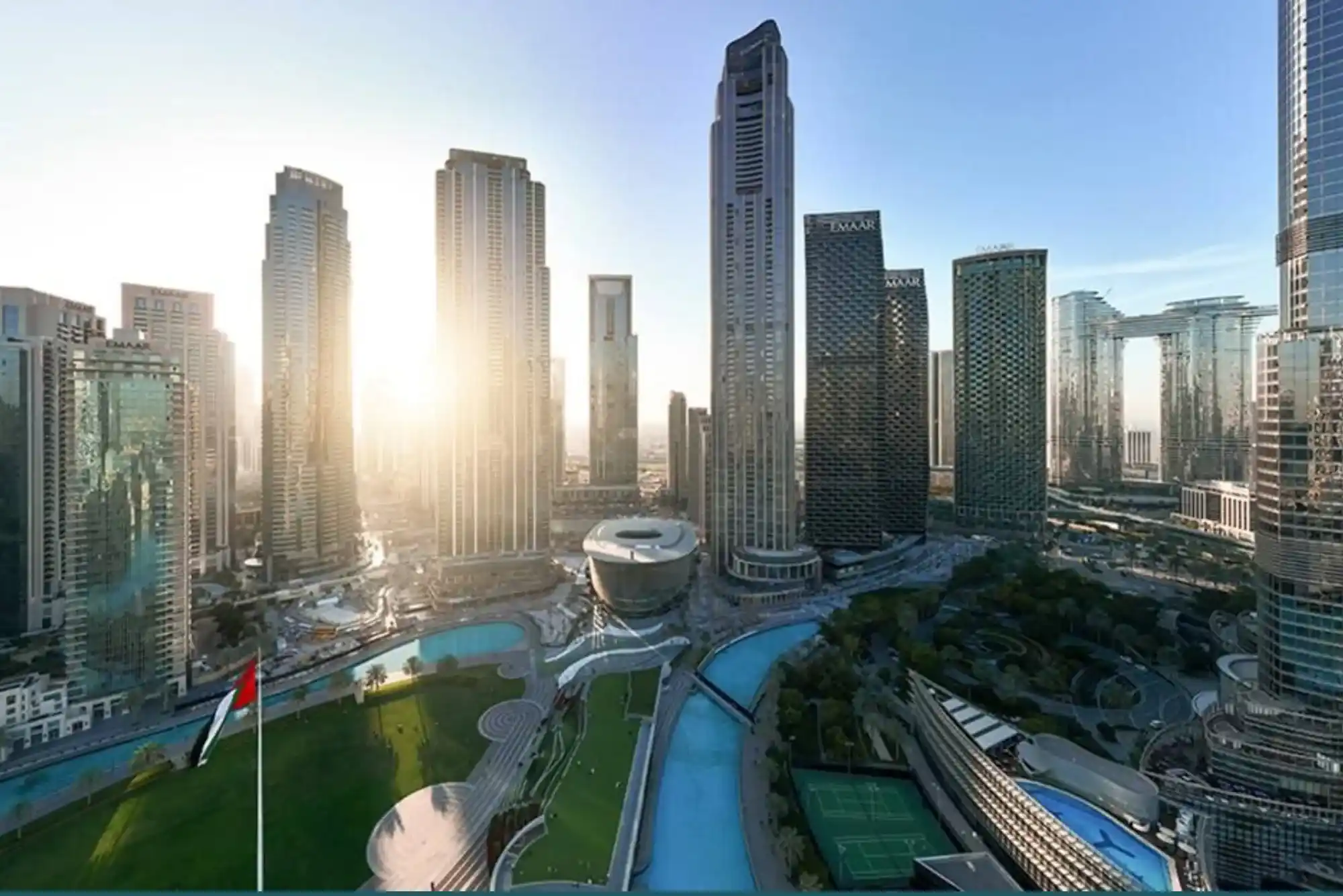

Dubai has become a global hub for real estate investment, attracting buyers from around the world. With its booming economy, luxurious lifestyle, and tax-free environment, it offers unmatched opportunities for property buyers. Whether you are looking for residential apartments, villas, or commercial spaces, Dubai provides a variety of options. This guide will walk you through the essentials of buying property in Dubai, ensuring a smooth and informed purchase process.

Why Invest in Dubai Real Estate

Dubai offers a lucrative real estate market due to its strong economy, strategic location, and investor-friendly regulations. The city provides tax benefits, high rental yields, and a stable economy, making it a preferred destination for property buyers. Investors can also benefit from residency visas, allowing them to enjoy the luxurious lifestyle Dubai offers. With various high-end developments, waterfront properties, and gated communities, there is something for everyone.

Understanding the Dubai Property Market

The real estate market in Dubai is diverse, catering to both luxury and affordable property segments. Key areas include Downtown Dubai, Palm Jumeirah, Dubai Marina, and Business Bay. Off-plan properties offer excellent investment potential, often available at lower prices with flexible payment plans. The secondary market is also robust, providing ready-to-move-in properties. Market trends indicate steady growth, making it an opportune time for investment. Buyers can explore options through platforms like UAE Property Finder to find the best deals.

Types of Properties Available in Dubai

Dubai offers a range of properties, including apartments, townhouses, villas, and commercial spaces. Freehold properties allow expatriates to own property in designated areas, while leasehold properties are available for a specific duration. Popular developments include Emaar Beachfront, Dubai Hills Estate, and Jumeirah Village Circle. Those looking for luxury can explore high-end residences on Palm Jumeirah or waterfront apartments in Bluewaters Island.

Legal Requirements for Buying Property in Dubai

Foreign investors can buy freehold properties in designated areas. The process involves signing a sales agreement, paying a deposit, and registering the property with the Dubai Land Department. Buyers must ensure the developer is registered and the property is approved by RERA. Legal due diligence is essential to avoid any potential issues. Consulting with property experts or using platforms like Property for Sale in Dubai can simplify the process.

Financing Options for Property Buyers

Buyers can finance their purchase through mortgage loans offered by banks and financial institutions. The loan-to-value ratio varies based on residency status, with expats eligible for up to 80% financing. Mortgage approval requires income verification and credit assessment. Payment plans for off-plan properties provide flexibility, allowing buyers to pay in installments. Understanding financial commitments and working with mortgage advisors is crucial for a smooth transaction.

Step-by-Step Guide to Buying Property in Dubai

The property buying process in Dubai involves multiple steps. The buyer must select a suitable property, negotiate the price, and sign a memorandum of understanding (MOU). A 10% deposit is typically required, followed by finalizing financial arrangements. The transfer of ownership is completed at the Dubai Land Department. Engaging a real estate agent can provide guidance, ensuring a hassle-free experience. Using UAE Property Finder simplifies property searches and helps buyers find verified listings.

Best Areas to Buy Property in Dubai

Dubai offers prime locations for investment, each catering to different lifestyles and budgets. Downtown Dubai is known for luxury apartments near the Burj Khalifa. Dubai Marina provides waterfront living, while Jumeirah Village Circle offers affordable family-friendly housing. Business Bay is ideal for commercial and residential investments. Buyers can explore properties through Property for Sale in Dubai to find suitable options.

People Also Ask

What are the benefits of buying property in Dubai? Dubai offers tax-free property ownership, high rental yields, and residency visas for investors. The city’s economic stability and world-class infrastructure make it an attractive investment destination.

Can foreigners buy property in Dubai?

Yes, foreigners can buy freehold properties in designated areas. The process is straightforward, and investors can obtain a residency visa based on their property purchase.

What is the average cost of property in Dubai?

Property prices vary based on location and type. Luxury apartments in Downtown Dubai can range from AED 1.5M to AED 10M, while villas in Palm Jumeirah can exceed AED 20M.

How can I finance a property purchase in Dubai?

Banks and financial institutions offer mortgage options with flexible payment plans. Expats can obtain financing with a down payment of 20% to 25%, depending on their financial profile.

Is Dubai real estate a good investment?

Yes, Dubai’s real estate market provides strong rental returns, appreciation potential, and investor-friendly regulations, making it a profitable long-term investment.

Conclusion

Buying property in Dubai offers numerous benefits, from financial gains to lifestyle perks. With a transparent legal framework, a diverse property market, and high rental yields, Dubai remains a top choice for investors. Using trusted platforms like UAE Property Finder helps buyers find the best deals. Whether looking for a dream home or a lucrative investment, Dubai’s real estate market has something for everyone.